To stay competitive, they increasingly turn to sophisticated tools like cost behavior analysis and contribution margin calculations. These financial metrics provide essential insights that can significantly impact a company’s profitability. Other financial metrics related to the Contribution Margin Ratio include the gross margin ratio, operating margin ratio, and net profit margin ratio. These ratios provide insight into the overall profitability of a business from different perspectives. Yes, it means there is more money left over after paying variable costs for paying fixed costs and eventually contributing to profits.

How does the contribution margin affect profit?

It’s also a helpful metric to track how sales affect profits over time. While there are plenty of profitability metrics—ranging from the gross margin down to the net profit margin—the contribution margin metric stands out for the analysis of a specific product or service. Alternatively, companies that rely on shipping and delivery companies that use driverless technology may be faced with an increase in transportation or shipping costs (variable costs).

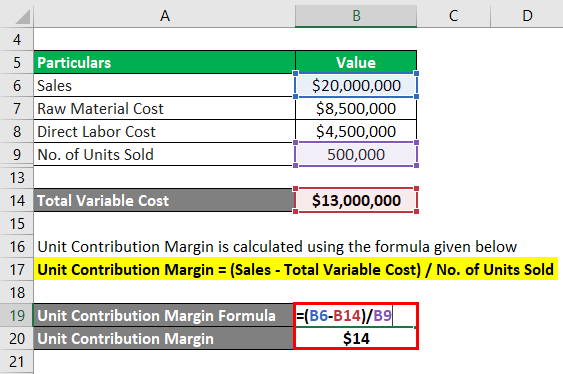

Step-by-Step Guide to Calculating Contribution Margin

The real power of understanding cost behavior comes into play when making critical business decisions. To set the right price for a new product, you must grasp how your costs will change as sales increase. When planning for future growth, cost behavior analysis helps predict how expenses will scale as your business expands. It even plays a vital role in break-even analysis, helping you pinpoint exactly when your venture will start turning a profit.

Best Excel Courses For Finance And Accounting In 2024

As you can see, contribution margin is an important metric to calculate and keep in mind when determining whether to make or provide a specific product or service. More importantly, your company’s contribution margin can tell you how much profit potential a product has after accounting for specific costs. Now, the fixed cost of manufacturing packets of bread is $10,000. Thus, the total manufacturing cost for producing 1000 packets of bread comes out to be as follows. As a business owner, you need to understand certain fundamental financial ratios to manage your business efficiently.

- The same will likely happen over time with the cost of creating and using driverless transportation.

- In short, profit margin gives you a general idea of how well a business is doing, while contribution margin helps you pinpoint which products are the most profitable.

- To illustrate how this form of income statement can be used, contribution margin income statements for Hicks Manufacturing are shown for the months of April and May.

Gross profit margin, on the other hand, looks at the cost of goods sold (COGS), which includes both fixed and variable costs. Ultimately, gross profit margin is a measure of the overall company’s profitability rather than an analysis of an individual product’s profitability. While contribution margin is an important business metric, how you calculate variable costs influences the number. And, as a pretty granular number, it gives you insight into a specific product’s profitability, but not the overall company’s profits. For a more holistic view, use it with other profitability ratios such as gross profit, operating profit and net profit.

One way to express it is on a per-unit basis, such as standard price (SP) per unit less variable cost per unit. The variable portion of the firm’s costs is deducted from the revenue. Variable costs refer to costs that change when volume increases or decreases. Some examples include raw materials, delivery costs, hourly labor costs and commissions.

Fixed costs are costs that are incurred independent of how much is sold or produced. Buying items such as machinery is a typical example of a fixed cost, specifically a one-time fixed cost. Regardless superstream improves the australian superannuation system of how much it is used and how many units are sold, its cost remains the same. However, these fixed costs become a smaller percentage of each unit’s cost as the number of units sold increases.

In such cases, the price of the product should be adjusted for the offering to be economically viable. The companies that operate near peak operating efficiency are far more likely to obtain an economic moat, contributing toward the long-term generation of sustainable profits. Aside from the uses listed above, the contribution margin’s importance also lies in the fact that it is one of the building blocks of break-even analysis.

Therefore, it is not advised to continue selling your product if your contribution margin ratio is too low or negative. This is because it would be quite challenging for your business to earn profits over the long-term. The contribution margin ratio is also known as the profit volume ratio. This is because it indicates the rate of profitability of your business.

The more it produces in a given month, the more raw materials it requires. Likewise, a cafe owner needs things like coffee and pastries to sell to visitors. The more customers she serves, the more food and beverages she must buy. These costs would be included when calculating the contribution margin.

You work it out by dividing your contribution margin by the number of hours worked. Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Evangelina Petrakis, 21, was in high school when she posted on social media for fun — then realized a business opportunity.